JULY 2004

Sent: Sunday, July 04, 2004 7:41 PM Subject:

Bloom fears dollar & stock mkt. crash

Looks Like Gold Bull Market Is Wanting

To Reassert Itself ![]() Brian Bloom

Brian Bloom ![]() The gold chart below is clearly in

a bull trend is bouncing up off rising trendline (Note

most recent new high)

The gold chart below is clearly in

a bull trend is bouncing up off rising trendline (Note

most recent new high)

Unfortunately, this is not "good" news (for the US stock market).

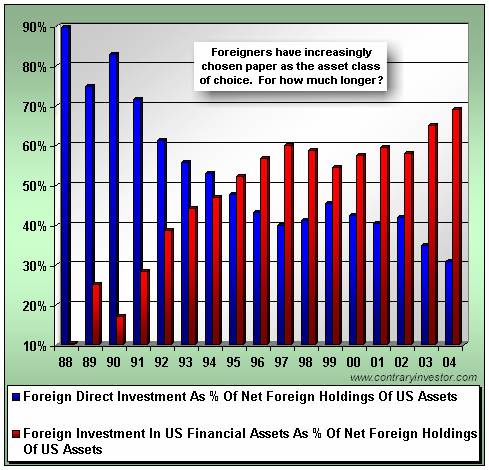

Don't like the action of the US Dollar, and don't like the fact that the US dollar (and US economy) is now extremely vulnerable to capital withdrawal (Note that 70% of Direct Foreign Investment in the USA is now in the form of "fickle" money.

I think we may be facing a US Market Crash. Note the falling volume on rising prices in the Dow Jones, and note how the Dow is now coming to the Apex of a triangle.

Could be any time in the next few months.

Brian Bloom

Australia, July 4 th 2004.

Sent: Monday, July 05,

2004 10:16 AM Subject: Russell On Dow, Gold &

US Dollar

Russell

On Dow, Gold & US Dollar http://www.gold-eagle.com/gold_digest_04/russell070304.html

Russell On Dow, Gold & US Dollar

Economists were expecting a 250 to 350 thousand rise in unemployment. The figures announced this morning was 112,000, which was less than half the median expectation. On the news the long T-bond surged 1 and 20/32nds and the Sept. Dollar Index dropped .70, breaking below the support in what looks suspiciously like a "head-and-shoulders" top."

The two paragraphs below are from the always excellent King Report (July 1 report) --

"A stunningly disturbing Chicago PMI trumped the Fed rate hike. The action in the markets yesterday suggested a change in economic perceptions. It could be the beginning of the end. The ugly ChicagoPMI details: 56.4 expected; employment fell to 53.6 from 54.8; production collapsed to 53.9 from 71.1; new orders collapsed to 56.8 from 74.4; prices paid jumped to 84.5 from 80.

"You can forget all the post mortems on the Fed decision and communiqué; the real talk in the money world yesterday was the astonishing collapse in the Chicago PMI."

I keep harping on the thesis that following a burst bubble (learning from the Japanese experience) it will require massive inflation to keep the US economy from sinking into recession and deflation.

Along these lines, M-3, the broad money supply, was down $10.4 billion for the latest week ended June 21.

This morning the Sept. 30 year T-bond was up 1 and 18/32nds to 108.13. This was a new high on the rally that started on May 13, at which time the bond was selling at 101.24. So is the bond market thinking inflation or deflation? You make the call.

On the rebound from the 2000-2002 down-leg of the bear market, the Dow regained 78 percent of its losses, the S&P regained just short of 50 percent of its losses, and the Nasdaq recovered 26% of its losses. Conclusion -- the blue chip D-J Industrial Average put in, by far, the strongest performance.

In analysis, it often pays to see what the strongest stock average is doing. And below we see the story. This is a daily chart of the Dow. And the following are my observations.

The Dow failed to confirm the new recovery highs in the Transportation Average. Bearish.

The Dow chart depicts a series of declining peaks. Bearish.

The shorter (50-day) moving average turned down on March 9. Bearish.

The blue histograms at the bottom of the chart are just breaking below zero. Bearish.

RSI at top of chart rallied above it previous peak, unconfirmed by the Dow. Bearish.

My conclusion based on the action of the Dow is that this market is facing potential major trouble.

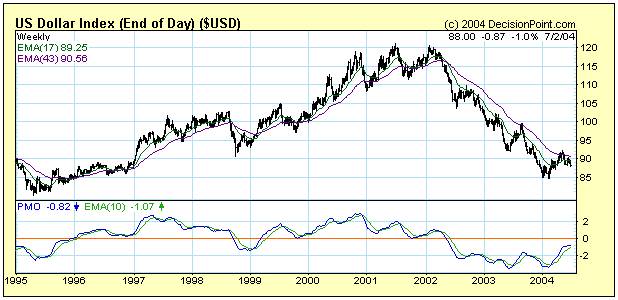

The next chart I want to show is a daily chart of the US dollar. This too, is not a pretty picture. Here we see the Dollar Index breaking below its June 8 low. We also see the (red) 50-day moving average new well below the (blue) 200 day moving average. Note that both of these MAs are now trending down, meaning the momentum for the dollar is to the downside. On top of everything else, the blue histograms are about to turn negative. As I said, it's not a pretty picture.

There's an irony in the current situation. The weaker the US economy, the more the need for the Fed to increase liquidity and the greater the need for the government to spend and run deficits -- both processes calculated to ward of the forces of deflation.

But the more the Fed inflates, and the larger the government deficits, the weaker the dollar. If the Fed and government are successful in warding off deflation, the dollar's fate is still in question. If deflation takes over, the international value of the dollar could cave in -- since deflation would crush the US economy and turn foreigners bearish on the dollar.

Either way, the dollar would be in danger. Which is one of the important reasons to hold gold.

As I see it, the US economy is showing signs of slowing down. This means that the Fed will be extremely hesitant to raise rates any further, particularly prior to the November election. The current low (1.25 percent) Fed funds make the dollar unattractive from an interest and income standpoint.

Thus, the whole stock market-US economy picture now seems to be in limbo, with the possibility that the stock market and the US economy could tip either way.

On this basis, the stock market remains both confusing and unattractive for retail investors. This is reflected in the current low volume on the exchanges. Nobody really know what to do, and this leaves the day-to-day trading to the hedge fund managers, program traders and the speculators.

Banks which hold the controlling stock in the Federal Reserve Corporation:

Rothschild Banks of London and Berlin

Lazard Brothers Bank of Paris

Israel Moses Sieff Banks of Italy

Warburg Bank of Hamburg and Amsterdam

Lehman Brothers Bank of New York

Kuhn Loeb Bank of New York

Chase Manhattan Bank of New York

Goldman Sachs Bank of New York.

Don Golden

Russell Comment -- I've seen this list before, I believe I saw it first in McMaster's "Reaper" report. Can any subscriber verify this list? It is kinda shocking. Ah, the secrets of the temple.

Richard Russell

Editor-in-chief - DOW THEORY LETTERS

www.dowtheoryletters.com/dtlol.nsfJuly 3, 2004

The inimitable and venerable Mr. Russell gained wide recognition via a series of over 30 Dow Theory and technical articles that he wrote for Barron's during the late-'50s through the '90s. Through Barron's and via word of mouth, he gained a wide following. Russell was the first (in 1960) to recommend gold stocks. He called the top of the 1949-'66 bull market. And almost to the day he called the bottom of the great 1972-'74 bear market, and the beginning of the great bull market which started in December 1974.

:Politics: Missing in Action: $20 Billion

by Geov Parrish©

http://www.seattleweekly.com/features/printme.php3?eid=55097

July 14 - 20, 2004

The CEO and founder of Adelphia Communications has been convicted of looting his company of hundreds of millions of dollars. Kenneth Lay has (finally) been indicted for his Enron dealings. What lesson may we learn?

Perhaps this: If you really want to steal a lot of money and get away with it, skip the private sector and go with government work.

While business corruption headlines briefly resurface, virtually no attention has been paid to a trio of reports that, combined, paints a picture of occupied Iraq as a place where staggering amounts of public money have been mishandled or stolen with little or no oversight.

Let us start with the White House itself, which helpfully buried, on the Friday afternoon before the July Fourth weekend, its release of a White House Office of Management and Budget report revealing that of the nearly $20 billion earmarked by Congress for reconstruction in last fall’s emergency Iraq spending bill, only a tiny $366 million has actually been spent. Breaking it down, we discover that, in the 14 months we officially occupied Iraq, we spent none of our own money on roads, nothing on hospitals and public health, nothing on clean water. The biggest chunks—about $100 million each—were spent on training Iraqi police and trying to restore the constantly sabotaged electrical grid. What little progress has been made has come almost entirely from foreign governments, private donors, and Iraq’s oil money.

No wonder the Iraqi public is furious with Americans for not honoring our word on the street. Americans should be angry, too. In January, the OMB originally estimated that $10.3 billion of the money would be spent by now. And when President Bush’s request for $87 billion in emergency funding was rammed through Congress last fall, it was with the insistent message that the money was needed immediately, if not sooner.

Never mind.

But Iraqis deserve to be even angrier about the fate of their own money. Iraqi oil exports, remember, were also supposed to be helping with both security and the reconstruction effort.

Problem is, nobody has any idea where the money’s gone.

The Coalition Provisional Authority, the U.S.–run agency that put itself out of business with the June 28 handover, didn’t even get around to appointing an auditor for its funds until April, after the date of its dissolution was fixed and with far too little time left to track down spending. The British nongovernmental organization Christian Aid took a crack at it, issuing a report when the handover took place that reads, in part: The “billions of dollars of oil money that has already been transferred into the U.S.–controlled Coalition Provisional Authority has effectively disappeared into a financial black hole. . . . The U.S.–controlled coalition in Baghdad is handing over power to an Iraqi government without having properly accounted for what it has done with some $20 billion of Iraq’s own money.”

Now, that’s not the $20 billion of American taxpayer money, which is a different pool, withheld due to ineptitude, security concerns, and lawsuits launched by various Friends of Dick and George who didn’t get the contracts they wanted. But we spent that much of Iraq’s money—we took it from Iraq’s public treasury— and nobody knows where it’s gone. Here’s an educated guess: Halliburton. Here’s another: Bechtel.

For others, consult (Kenneth) Lay’s Christmas card list.

To top it all off, after Christian Aid released its report, and a day after the handover, the Coalition Provisional Authority auditor issued his own series of unfinished reports, saying, essentially, “Yep. They’re right. We have no idea where all that money went.”

Aside from the sheer magnitude of the theft involved here, this matters because the looting of Iraq isn’t over—it’s just moved to a new phase. One of the things a sovereign (albeit handpicked) government of Iraq can do, which, under international law, an occupying army can’t do, is sell off Iraq’s public resources. That’s what’s now under way. The Bush administration has an ambitious plan, unprecedented among underdeveloped countries, to privatize virtually every agency ever run under the umbrella of the government of Iraq. It’s a fire sale to pyromaniacs, and aside from the fact that Iraq’s public resources will be sold off to mostly foreign, mostly American bidders at pennies on the dollar, the contracts that they in turn let are likely to set new standards for corruption and “cost-plus” accounting—particularly in a country that barely has its own police force, let alone one capable of investigating high-level wheeling and dealing of this order.

The whole thing stinks to high heaven, and the same curious set of companies keeps reappearing as stars in this little amorality play. These vast fortunes may not have been what motivated the invasion of Iraq, but it’s hard to remember a time when taxpayers have paid so much— hundreds of billions of dollars already, plus all those lost lives—and the benefits have accrued to such a well-defined few.

Crime pays. You just have to know whom to rob.

gparrish@seattleweekly.com

Copyright © 1997-2004, Seattle Weekly and Village Voice Media. All rights reserved.

Forwarded by Raja Mattar